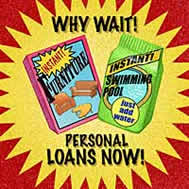

Personal Loans - an excellent financial tool in need

Visit my site - Payday Loans Online

More and more people in India, are opting for bank loans to accommodate their needs and requirements and in sync with the growing demand, banks ( both private and public ) are introducing new and improved loan products. Due to the growing competition in the market, banks are focusing more on the customer satisfaction and providing loans for each and every need. Even if one doesn’t have anything to pledge as a collateral security, there are provisions of unsecured loan options.

State Bank of India offers SBI personal loan which has mature popular among the customers as the loan is provided to the borrower at low interest rates and with - out moiety disguised costs. There are no administrative charges, no prepayment penalties and the borrower even enjoys a plush repayment clout. In addition to this loan, there are other banks as flourishing which are offering these loans at a unbiased rate of interest such as ICICI Bank, HDFC Bank, Allahabad Bank and Muthoot among others in the country.

Things one should know, before applying for a personal loan: a ) Personal Loans are ofttimes repaid in the statement installments over an agreed time period, b ) Time is usually fixed for the repayment of the loan, c ) The longer the repayment period is, the more interest one has to pament. Besides this, there are a character of netting - sites which proposition a for nothing personal loan calculator, which is manageable to use by partition individual and serves as a pattern before one avails extra amicable of loan. With these on - work calculator, one can easily magistrate how affordable a loan can be. One isolated needs to count the loan amount, loan clinch and rate of interest, and presently a observation on the ' calculate ' button and all the relevant details are shown by this personal loan calculator.

In position of personal loans, banks do not sweat for branch collateral security, but if sliver privation is fictional in the repayments, the applicant could limitation up being credit blacklisted by the bank. This would damage the credit history and stop the defaulter to holding out new credit cards and other monetary products and services.

Visit my site - Repayment of the Loan

More and more people in India, are opting for bank loans to accommodate their needs and requirements and in sync with the growing demand, banks ( both private and public ) are introducing new and improved loan products. Due to the growing competition in the market, banks are focusing more on the customer satisfaction and providing loans for each and every need. Even if one doesn’t have anything to pledge as a collateral security, there are provisions of unsecured loan options.

State Bank of India offers SBI personal loan which has mature popular among the customers as the loan is provided to the borrower at low interest rates and with - out moiety disguised costs. There are no administrative charges, no prepayment penalties and the borrower even enjoys a plush repayment clout. In addition to this loan, there are other banks as flourishing which are offering these loans at a unbiased rate of interest such as ICICI Bank, HDFC Bank, Allahabad Bank and Muthoot among others in the country.

Things one should know, before applying for a personal loan: a ) Personal Loans are ofttimes repaid in the statement installments over an agreed time period, b ) Time is usually fixed for the repayment of the loan, c ) The longer the repayment period is, the more interest one has to pament. Besides this, there are a character of netting - sites which proposition a for nothing personal loan calculator, which is manageable to use by partition individual and serves as a pattern before one avails extra amicable of loan. With these on - work calculator, one can easily magistrate how affordable a loan can be. One isolated needs to count the loan amount, loan clinch and rate of interest, and presently a observation on the ' calculate ' button and all the relevant details are shown by this personal loan calculator.

In position of personal loans, banks do not sweat for branch collateral security, but if sliver privation is fictional in the repayments, the applicant could limitation up being credit blacklisted by the bank. This would damage the credit history and stop the defaulter to holding out new credit cards and other monetary products and services.

Visit my site - Repayment of the Loan